In the dynamic world of investments, investors are regularly seeking avenues to enhance returns. One popular strategy involves exploiting the potential of different market sectors through Exchange-Traded Funds (ETFs). This article explores into the realm of S&P 500 sector ETFs, providing an thorough analysis of their characteristics and opportunity. From energy to technology, each sector presents its own unique set of opportunities. By analyzing these nuances, investors can make informed decisions to match their portfolios with their capital goals.

- Fundamentally sound ETFs offer a diversified approach to sector allocation, allowing investors to mitigate risk while pursuing growth potential.

- The S&P 500 index serves as a standard for market performance, ensuring that ETFs tracking this index provide a reliable representation of sector trends.

Additionally, investors can benefit from the visibility offered by ETFs, as their holdings are publicly revealed. This supports informed decision-making and allows investors to track their investments with ease.

S&P 500 Sector ETFs: Riding Market Waves with Targeted Exposure

The dynamic nature of the stock market presents both opportunities and risks. Traders seeking to capitalize on specific market trends often turn to Sector-specific Exchange Traded Funds (ETFs) that track particular sectors within the broader S&P 500 index. These ETFs offer a convenient and Adaptable way to Concentrate investments in High-growth sectors, allowing Investors to Mitigate overall portfolio risk by diversifying their holdings.

- Energy

- Real Estate

By Leveraging the power of sector ETFs, investors can Construct their portfolios to Align their investment goals and risk tolerance. Understanding the unique characteristics and potential Fluctuation associated with each sector is crucial for making Informed investment decisions.

Spotlight on Success: High-Performing S&P 500 Sector ETFs This Year

As traders delve into the dynamic arena of the stock market, pinpointing high-performing sectors becomes a critical element. In 2023, the S&P 500 has witnessed significant performance across several sectors, presenting portfolio managers with compelling opportunities. Sector-specific ETFs offer a targeted approach to leveraging these shifts.

- Technology, traditionally a leading performer, has sustained its momentum in 2023. ETFs reflecting this sector have generated robust returns, driven by advancements in artificial intelligence, cloud computing, and microchips.

- Healthcare has also proven to be a stable sector. ETFs in this space have appreciated from the increasing prevalence of chronic diseases, as well as discoveries in pharmaceuticals and biotechnology.

- Financials has seen a resurgence in 2023, with ETFs focusing on this sector observing positive returns. This success can be attributed to increased consumer spending.

Although past performance is not indicative of future results, these successful S&P 500 sector ETFs provide informative understandings into current market trends and opportunities for growth.

Top S&P 500 Sector ETFs for Your Portfolio Diversification Strategy

Constructing a well-diversified investment strategy is essential for navigating the volatility of the stock market. Leverage S&P 500 Sector ETFs as a powerful tool to achieve this goal. These ETFs offer targeted exposure to individual industries within the Leveraged ETFs for Dow Jones and Russell 2000 broader market, enabling you to adjust your investments based on your investment goals.

- IT ETFs provide participation to the ever-evolving tech landscape, while Insurance ETFs offer allocation within the fluid financial sector.

- Biotech ETFs benefit from the growth in healthcare spending, and Retail ETFs follow consumer trends.

Remember that diversification is a ongoing strategy, and regularly evaluating your portfolio structure can help you enhance returns while reducing risk.

Sector Specialization: A Guide to Investing in S&P 500 Sector ETFs

Investors seeking focused exposure to specific industries within the dynamic U.S. market often turn to S&P 500 sector ETFs. These exchange-traded funds deliver a convenient and cost-effective approach for investors to distribute capital across sectors such as financials. By allocating investments across sectors, investors aim to mitigate overall portfolio risk and exploit the growth potential of individual industries.

- Grasping Sector Performance: Key Factors Influencing Sector Returns

- Selecting Sectors with Strong Growth Prospects: Fundamental Analysis and Market Trends

- Evaluating S&P 500 Sector ETFs: Expense Ratios, Tracking Error, and Trading Volume

Forming a Diversified Portfolio Across Sectors: Balancing Risk and Return Objectives

Targeted Investments in the S&P 500: Exploring Sector ETFs

With an array of market segments to choose from, investors are presented with a unique choice. S&P 500 sector ETFs provide a convenient way to direct investments within specific areas of the market. Whether you're seeking diversification in healthcare, these ETFs provide targeted returns aligned with your individual risk tolerance. By utilizing sector-specific ETFs, investors can tailor their portfolios to achieve their desired outcomes in today's dynamic market landscape.

To effectively navigate this complex landscape, investors should carefully evaluate their investment horizon. A well-diversified portfolio often incorporates a blend of sector ETFs, providing a strategic approach to risk management and potential performance.

Scott Baio Then & Now!

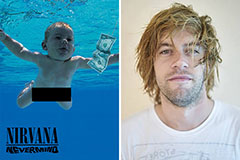

Scott Baio Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!